Not too long ago, I heard something about a billionaire paying for a $170 million dollar painting with an Amex Card.

“Those points!”

Apparently, he and his family plan to use the points to travel for the rest of their lives, which is a definite perk, though probably not why they made the decision.

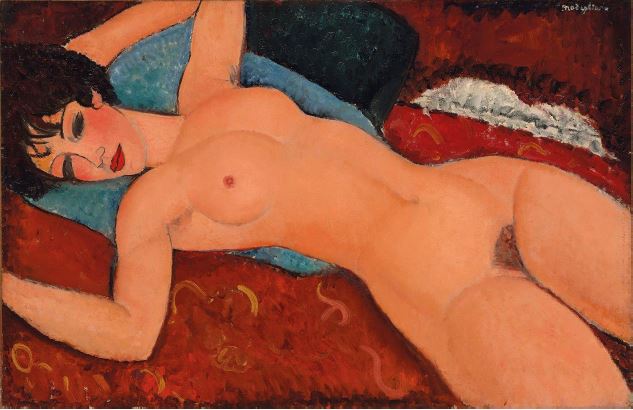

When I bought paint at Home Depot recently (is there is a big difference between a glorious Modigliani nude and 5 litres of discount primer?), I thought about the rewards points. Like many people, we have a couple of credit cards. When you’re making lots of purchases, and not planning to carry a balance, where can you get the most bang for your buck?

I drew up a quick comparison:

| Card | RBC Rewards Visa Gold | Signature RBC Rewards Visa | PC Financial World Mastercard |

|---|---|---|---|

| Annual Fee | 0 | $39 | 0 |

| Points by Spend Charge | 1 point for every $2 spent | 1 point for ever $1 spent | 10 pc points per $1 |

| Points Redemption | 14,000 points will get $100 gift card | 14,000 points will get $100 gift card | 20,000 PC points equals $20 in groceries |

| Flight Redemption | 50,000 points = $500.00 in flights | 50,000 points = $500.00 in flights | |

| If I Spend $100, I will have | 50 points | 100 points | 1000 points |

| For that $100, I will get | $0.35 towards certain vendors | $0.71 towards certain vendors | $1 in groceries |

| Or for travel | $0.50 towards travel | $1 towards travel |

My takeaway: wow, you have to spend a lot of money to get $500 in rewards points.

But also: PC Groceries for the win!

You can read more on Canadian credit card rewards points in Moneysense.